Four Bitcoin Indicators That Every Experienced Investor Knows — A recap of the bear market

About a year ago, we published an article about the most common indicators to analyze the crypto market cycle. Let’s have a look back how those indicators played out during the bear market.

Fear and Greed Index

This is probably the most famous crypto market indicator, which puts the current emotion level of investors in a range between 0 (extreme fear) to 100 (extreme greed).

The indicator is measured via the following metrics:

- Volatility (25% weight)

- Social Media (15%)

- Surveys (15%)

- Dominance (10%)

- Trends (10%)

What are the right conclusions:

Being within the “Extreme Fear” range does not mean that the market rises any minute and vice versa, but as Warren Buffet said: “Be fearful when others are greedy, and greedy when others are fearful”.

Of course, this so-called “Contrarian Investing Strategy” is just one of many possible ones you can deploy, but be careful of markets that feel overhyped and look for those that don’t garner as much attention.

Please find the indicator and details about the metrics here.

Now let’s have a look at the history to see how the indicator performed:

Source: lookintobitcoin.com

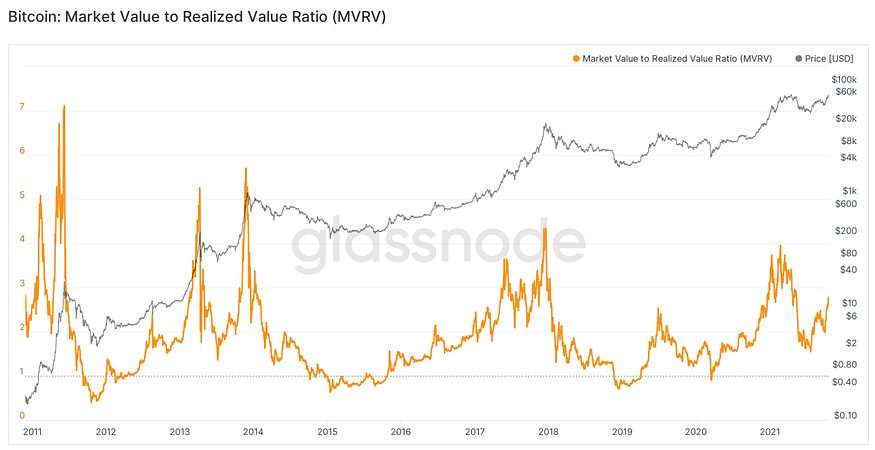

Market Value to Realized Value (MVRV Ratio)

The MVRV gives you an indication of whether people are potentially selling their Bitcoin with profit or loss. The indicator is calculated as follows:

MVRV = market cap / realized cap

Other than market cap -which is the current Bitcoin price multiplied by the circulating supply- the realized cap defines the network’s value by multiplying each coin with the price at the moment when the coin was bought.

Therefore, a high MVRV means that, on average, people have bought Bitcoin below its current trading price and have a lot of unrealized gains. On the other hand, a low MVRV means that most people are sitting on a loss because they bought Bitcoin higher than the current trading price.

How to make the proper conclusion:

A low MVRV indicates a market bottom (especially below >=1), whereby a high MVRV indicates a market top (especially >= 3).

How did that play out looking back:

Source: academy.glassnode.com

HODL Waves

HODL (Hold on for Dear Life) Waves tell a story about the current holding period of Bitcoin. These waves are usually depicted in a colorful chart, where each color signifies a time period reflecting how long the respective coin has been dormant within a wallet. The warmer the chart colors are, the more coins have been recently moved, and vice versa. Coin HODLers are thereby associated with smart money, whereas short-term HODLers are associated with weak money.

Why you should care:

If the warm colors increase and the cold colors decrease, it indicates that HODLers sell their bags to weak money traders — this is considered a bearish signal. The contrary is associated with accumulation by the HODLer and is seen as a bullish signal. Therefore, if all the long-term HODLers sell, then a bear market is more likely to be expected.

Please find the chart here.

Source: unchained.com

So what is the correct interpretation of the indicator for 2022 and 2023? Feel free to post your opinion in the comment section!

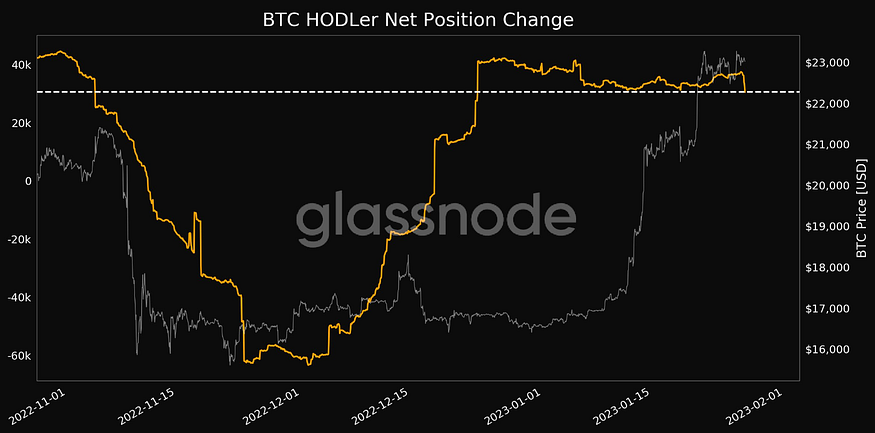

HODLer Net Position Changes (HNPC)

This indicator tells you whether long-term HODLers (previously noted as the smart money) are accumulating or selling their Bitcoin. In particular, wallets that hold tokens for more than six months are tracked on whether they hold/buy or sell. A positive value of this metric means that more coins are held or bought than are sold by the user.

The proper conclusion:

A positive HNPC is a bullish signal because it indicates that the smart money is accumulating and holding, rather than selling. A negative value, on the other hand, indicates a bearish signal.

Please find the chart here (registration necessary).

Source: coindesk.com

Disclaimer

We hope that this article gave you the right tools you need to better analyze the market and make less emotional investment decisions. However, it’s important to never forget that these measures only provide indications about the current market drivers and future price movements.

History doesn’t repeat, but it often rhymes.

Find Out More About DuckDAO🐥

DuckDAO is a community-backed digital asset incubator that provides promising early-stage crypto startups with the expertise, financial resources, and marketing power needed to fast-track their progress on the path to success.